Yes, it is indeed possible to have two OPay accounts, with each account operating with its own separate phone number and Bank Verification Number (BVN). This can be helpful if you want to keep personal and business finances separate, or for other valid reasons. However, it’s very important that you meet specific requirements when setting up and managing these accounts to ensure everything runs smoothly and remains compliant with OPay’s policies.

2 Requirements to Have Two OPay Accounts

1. Separate Phone Numbers

For each OPay account, you are required to use a unique phone number. This phone number is not only used for communication but also serves as your account number. Therefore, it is important that each account you open has a distinct and separate phone number from the other. This helps OPay maintain proper account identification and security for each user.

Additionally, the phone number is essential for receiving one-time passcodes (OTPs), transaction notifications, and other account-related updates, so having a different phone number for each account helps keep everything organized.

2. Unique Bank Verification Numbers (BVNs)

In Nigeria, each individual is issued a unique Bank Verification Number (BVN) that is linked to their identity for financial services. When opening an OPay account, you will be required to use a different BVN for each account. This is a security measure that ensures that each account is properly verified and aligned with the regulations set by the Central Bank of Nigeria (CBN).

Since each person can only have one BVN, using separate BVNs for each account allows you to comply with the rules while keeping your personal and business financial activities distinct.

READ MORE: Complete List of OPay Offices in Nigeria: Locations & Contact Information

Why These Requirements Are Important

Both the phone number and BVN are critical for OPay to ensure that their security policies are upheld. By verifying both your phone number and BVN, OPay can help prevent fraud, identity theft, and ensure that only you have access to your account. The system also ensures that your financial transactions are traceable and secure.

Having separate phone numbers and BVNs also enhances the credibility and reliability of your OPay accounts, making it easier for you to handle different transactions for personal or business purposes without worrying about violating any terms of service. It is important to note that these measures are not only for compliance with OPay’s policies but also to ensure the integrity of the Nigerian financial system.

Step-by-Step Guide to Creating Multiple OPay Accounts

Here’s a step-by-step guide to help you create and manage two separate OPay accounts with ease:

1. Download the OPay App

Before you start, you’ll need to have the OPay app installed on your phone. Here’s how you can do that:

- Visit the App Store: Go to the Google Play Store (for Android) or Apple App Store (for iPhone).

- Search for OPay: In the search bar, type “OPay” and select the OPay app from the search results.

- Download the App: Tap the “Install” or “Get” button to download and install the app on your phone.

- Open the App: Once downloaded, open the OPay app to begin the registration process.

2. Register Your First Account

After downloading and opening the OPay app, follow these steps to create your first account:

- Tap on “Sign Up”: The option to sign up will be available on the home screen of the app. Tap on it to get started.

- Enter Your Phone Number: The first step in the registration process will ask you for a phone number. Make sure you enter a phone number that you want to associate with this account. Remember, this phone number will be the account number for your OPay account.

- Verification Code: After entering your phone number, OPay will send a verification code via SMS to ensure the number is valid. Enter the code when prompted.

- Email and Password: Next, provide your email address and create a password for your OPay account. This password should be something secure, ideally a combination of letters, numbers, and special characters.

- Link Your Bank Account: After providing your email and password, the app will prompt you to link your bank account. This is necessary for withdrawing funds or making payments. Choose your preferred bank and follow the steps to link your bank account.

- Verify Your Identity: To complete the registration process, OPay will ask you to verify your identity by providing your Bank Verification Number (BVN). This is a mandatory step to ensure compliance with Nigerian financial regulations and to verify your identity.

- Complete Registration: Once all these steps are completed, you will have successfully registered your first OPay account. You can now start using it for personal transactions or other activities.

3. Register Your Second Account

To create a second OPay account, you’ll need to repeat the process, but with a different phone number and BVN. Follow these steps:

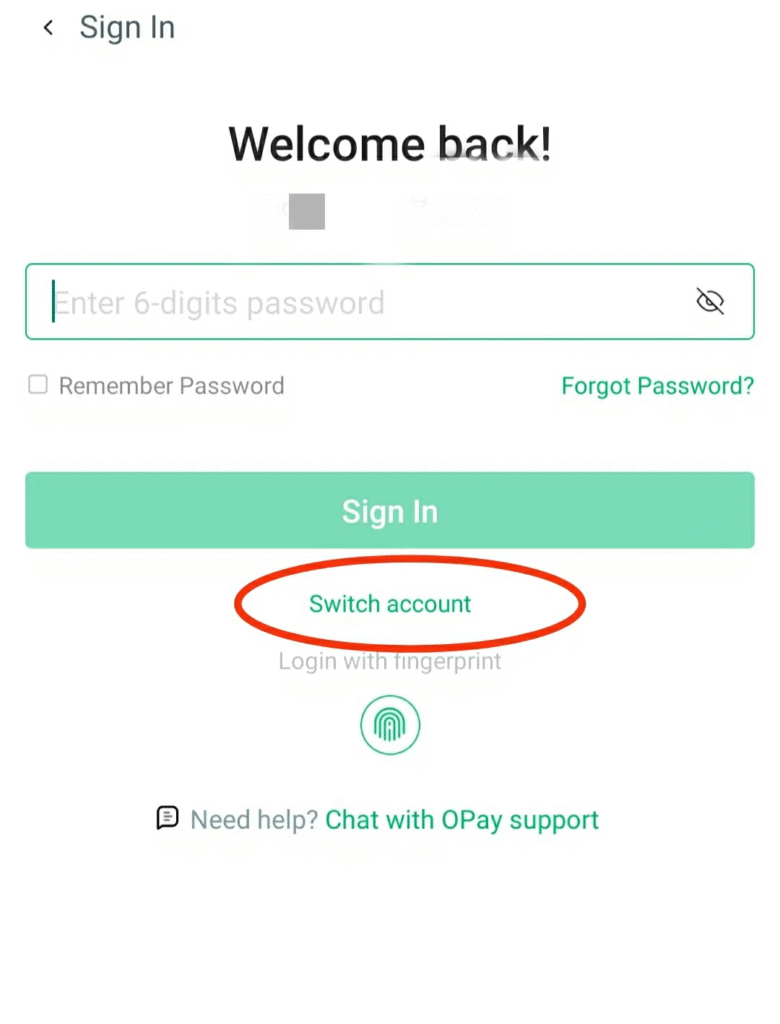

- Log Out of Your First Account: To avoid any confusion, you must log out of your first OPay account. Open the app, go to the settings or menu, and select the option to Log Out.

- Tap “Sign Up” Again: After logging out, tap on the “Sign Up” option to start the registration process for your second account.

- Enter a Different Phone Number: This time, enter a new, unique phone number that you want to use for your second account. It is essential to use a different phone number from your first account, as each OPay account requires its own phone number.

- Enter a New BVN: Just as your first account required a Bank Verification Number (BVN), your second account will also require a unique BVN. If you try to use the same BVN for both accounts, you will encounter an error, as each individual can only have one BVN associated with their identity.

- Complete the Sign-Up Process: As with the first account, provide your email address, create a secure password, and link your bank account to your second OPay account.

- Verification and Finalizing: Follow the same verification steps as before, ensuring that all your details are correct and that your second account is linked to the correct phone number and BVN.

Once you’ve completed these steps, you’ll now have two fully functional OPay accounts, each tied to a different phone number and BVN.

6 Benefits of Having Two OPay Accounts

Having two OPay accounts isn’t just about doubling your banking apps—it’s about significantly enhancing your financial management. By splitting your personal and business finances, you create a clear distinction between the two, which can greatly streamline your financial processes. Below are key reasons why having two OPay accounts can be a game-changer:

1. Separation of Personal and Business Transactions

One of the biggest advantages of having two OPay accounts is the separation of personal and business transactions. If you’re a small business owner or entrepreneur, keeping your personal spending separate from business-related expenses is crucial for both organization and tax purposes. With two OPay accounts, you can easily track how much you’re spending or receiving for personal and professional matters without the hassle of sorting through mixed transactions.

This clarity makes it easier to:

- Budget effectively: You can set clearer boundaries for how much you want to spend personally and how much you want to allocate toward your business.

- Prepare for taxes: When it’s time to file your taxes, separating business expenses from personal ones ensures you comply with tax laws and accurately report your income and deductions.

- Monitor cash flow: Whether it’s personal savings or business profits, tracking each account’s balance becomes much easier when they’re kept separate.

2. Increased Financial Flexibility

Having two OPay accounts allows you to manage your finances with greater flexibility. You can allocate funds for specific purposes—whether it’s for business purchases, investments, or personal expenses—without worrying about running out of funds for important transactions. You also get the ability to move money between accounts for seamless transactions, all while keeping the two different categories intact.

For example:

- Personal Account: You can use this for your day-to-day activities—paying bills, shopping, and transferring money to family and friends.

- Business Account: This can be used for processing payments from clients, paying suppliers, managing business-related subscriptions, or investing in your business growth.

With a clear separation, you’re less likely to make financial errors, which is common when personal and business finances get mixed.

3. Streamlined Financial Management

Having two OPay accounts can help you gain better control over your finances. Instead of juggling multiple apps or platforms to manage different aspects of your financial life, you can do everything from one place. Since both personal and business accounts are handled through OPay, it eliminates the need to switch between several different platforms to check balances, track transactions, or move funds.

With OPay’s simple and easy-to-use interface, you can also get instant transaction alerts, which can further help in managing both personal and business accounts in real time. This level of oversight makes it much easier to:

- Stay on top of spending: You will be able to track expenses for both your personal life and your business operations without missing a beat.

- Organize your savings goals: Whether saving for personal milestones or business growth, having two accounts allows you to prioritize savings goals separately.

4. Leveraging OPay Promotions and Benefits

Another significant benefit of having multiple OPay accounts is that you can take advantage of various promotions and benefits that OPay offers. OPay regularly runs various campaigns, such as bonuses, discounts, and rewards for specific types of transactions. With two separate accounts, you can potentially access these promotions more than once, giving you a double chance to earn rewards and maximize your benefits.

For instance:

- Personal Promotions: You might receive cashback or discount offers when making purchases or transferring money, which can add up over time.

- Business Incentives: OPay may offer special deals or rewards for business transactions, such as processing a certain number of payments or transferring funds for business-related purposes.

By having two accounts, you essentially double your chances of benefiting from these promotions, allowing you to save or earn more.

5. Better Control Over Business Cash Flow

For business owners, it’s essential to have control over cash flow—knowing when payments come in, when to pay suppliers, and how much profit the business is making. With a separate OPay business account, you can gain more visibility into your business’s financial health without any distractions from personal transactions.

This separation allows for better management of the business’s accounts payable and accounts receivable, ensuring that you can focus on making decisions to grow your business rather than being bogged down by personal finances.

6. Increased Security

When your personal and business transactions are kept in separate accounts, it enhances security. If something happens to one of your accounts, such as unauthorized access or an issue with a payment, you’re less likely to face the risk of affecting both your personal and business finances at the same time. Having separate accounts also reduces the likelihood of fraud, since both accounts are linked to different phone numbers and BVNs.

Conclusion

In summary, having two OPay accounts is not for a luxury—it’s a strategic financial move that can save you time, enhance your financial organization, increase your flexibility, and allow you to take full advantage of OPay’s promotions and benefits. Whether you’re an individual who wants to keep personal and business finances separate or a business owner looking for better control over cash flow, two OPay accounts can be the solution that revolutionizes the way you manage your money.

So, consider setting up that second account today—it’s a small change that can make a big impact on your financial efficiency!