The question “Who owns PalmPay in Nigeria?” has intrigued many in the fintech space. In short, PalmPay is co‑owned by two major Chinese technology firms—Transsion Holdings and NetEase—with strategic backing from Mediatek. Since its launch in 2018, PalmPay has leveraged this ownership structure and an aggressive growth strategy to become one of Africa’s leading mobile‑first financial services platforms. Let’s dive into everything you need to know about them.

Introduction: The Rise of PalmPay in Nigeria

Founded in 2018, PalmPay burst onto Nigeria’s fintech scene with a lucrative seed round and a partnership that pre‑installed its app on millions of smartphones. Within two years, it was licensed by the Central Bank of Nigeria (CBN) as a mobile money operator and, by 2023, had amassed over 30 million users across the continent. But behind this rapid expansion lies the story of its ownership and strategic investors.

Who Owns PalmPay in Nigeria?

PalmPay’s primary owners are:

- Transsion Holdings (via its Tecno subsidiary)

- NetEase

These two Chinese companies led and participated in a $40 million seed round that enabled PalmPay to launch officially in Nigeria in 2020. Transsion, known for manufacturing Tecno, Infinix, and Itel smartphones, pre‑installed the PalmPay app on an estimated 20 million devices, giving PalmPay instant access to a massive user base. NetEase, a leading Chinese internet and gaming company, provided technological expertise and additional capital.

The Role of Transsion in PalmPay’s Growth

Transsion’s involvement was pivotal:

- Lead Investor: Through its Tecno arm, Transsion spearheaded the $40 million seed funding.

- Preinstallation Partnership: PalmPay came preloaded on Tecno, Infinix, and Itel phones—brands that dominate Africa’s smartphone market.

- Distribution Leverage: By integrating PalmPay into existing mobile hardware ecosystems, Transsion accelerated user acquisition without the need for expensive marketing.

This deep integration between hardware and fintech allowed PalmPay to onboard hundreds of thousands of customers during its pilot phase, processing over 1 million transactions before its formal launch.

READ ALSO: Who Owns OPay in Nigeria?

NetEase and Other Chinese Investors

Alongside Transsion, NetEase and Mediatek joined the investment round:

- NetEase: Brought digital infrastructure expertise and strategic vision for scaling fintech services.

- Mediatek: A wireless communications hardware firm that supported app performance optimization and technical collaboration.

These investors saw Africa’s fintech market as a high‑growth opportunity and helped PalmPay build robust, scalable systems for payments, rewards, and financial services.

PalmPay’s Strategic Business Model

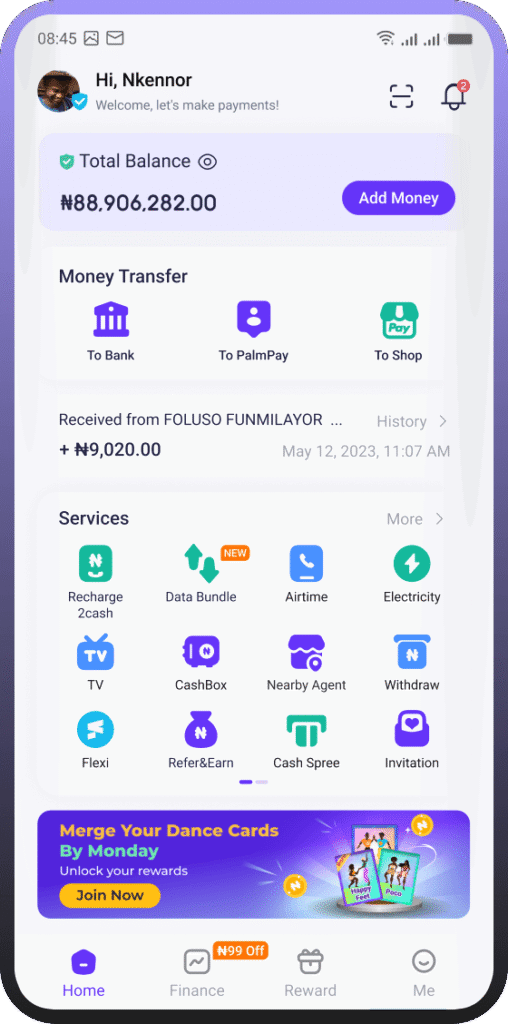

PalmPay’s growth hinges on a user‑centric incentives model:

- Exciting Discounts: Frequent promotions on airtime, data, and utility bills.

- Cash‑Back Rewards: Users earn a small percentage back on every transaction they make.

- Freebies & Earning Opportunities: Referral bonuses and game‑style rewards keep engagement high.

- No‑Fee Payments: Eliminating transaction fees for transfers and bill payments drives adoption.

This gamified approach, coupled with the app’s preinstallation, allowed PalmPay to stand out in Nigeria’s crowded mobile money landscape.

Key Milestones in PalmPay’s Journey

| Year | Milestone |

|---|---|

| 2018 | PalmPay founded and launched in Nigeria & Ghana |

| 2019 | Licensed as a Mobile Money Operator (MMO) by the Central Bank of Nigeria |

| 2020 | Rolled out full financial services in Nigeria |

| 2021 | Closed Series A funding |

| 2022 | Expanded operations into Ghana |

| 2023 | Recorded over 30 million users |

Each milestone reflects PalmPay’s expanding reach and the deepening of its service offerings across West Africa.

PalmPay’s Values and Vision

PalmPay operates under a set of core values that guide its mission:

- Customer First: Prioritizing user experience and trust.

- Striving for Excellence: Continuous improvement of products and services.

- One Team, One Dream: Collaborative culture across all markets.

- Open Communication: Transparency with users, regulators, and partners.

- Think Globally, Act Locally: Adapting global best practices to local needs.

- Taking Ownership of the Result: Accountability at every level.

These principles underpin PalmPay’s efforts to drive financial inclusion and digital empowerment.

Regulatory Approval and CBN Licensing

In July 2019, PalmPay secured its Mobile Money Operator (MMO) license from the Central Bank of Nigeria, enabling it to:

- Offer peer‑to‑peer transfers

- Facilitate bill payments

- Provide airtime and data top‑ups

- Run merchant settlements

This regulatory endorsement granted PalmPay legitimacy and allowed it to scale securely in Nigeria’s highly regulated financial ecosystem.

PalmPay CEO, Nwosu Says Customer Trust is Growing for the Fintech Industry

Recently, Mr. Chika Nwosu, Managing Director of PalmPay Nigeria, appeared on Channels TV’s Business Roundtable to discuss regulatory concerns within the FinTech ecosystem and provide expert insights into PalmPay’s operations:

- On Regulation and Trust

“Whatever is happening with regulation is for the good of the FinTech space in Nigeria. Initially, when we started, there was an issue of trust. However, I can tell you now that the last year after the cashless policy has seen the trust start to grow.” - Support for Regulators

Nwosu emphasized PalmPay’s commitment to working alongside regulators, noting that their goal is to strengthen leading FinTech players, including PalmPay, through sound onboarding policies and clear guidelines. - Ease of Doing Business

“Doing business in Nigeria for us is not easy, but Nigerians are embracing our app and digital payment,” he said, underscoring the market’s enthusiasm despite operational challenges. - Failed Transfers and Infrastructure

Addressing concerns about failed transactions, he explained: “Every institution has its business strategy and infrastructure. For us and the majority of FinTechs, we have a structure that makes transactions seamless.” - Onboarding Pause Across the Ecosystem

At the time of the interview, no FinTech had fully met the new regulatory requirements, so onboarding remains on hold across the entire industry. Nwosu reassured users: “If PalmPay completes their own today, we will start onboarding today.” - Customer Support Touchpoints

While PalmPay does not maintain traditional branch networks, Nwosu clarified that customers can visit walk‑in offices in Ikeja GRA and Opebi, as well as in 25 states nationwide (including Aba, Abuja, Lagos, Kano, and more). Alternatively, users can reach PalmPay via social media, call +234 201 888 6888, or email [email protected] for prompt assistance. - Trust and Security

“There is no day you won’t see on our app boldly written that we are licensed by the Central Bank of Nigeria (CBN) and our deposits are insured by the Nigeria Deposits Insurance Corporation (NDIC). PalmPay is here to stay,” Nwosu concluded, reaffirming the platform’s regulatory compliance and commitment to customer protection.

PalmPay vs. the Competition in Nigeria’s Fintech Space

Nigeria’s fintech sector features strong competitors, including OPay, Flutterwave, Moniepoint, and Paga. PalmPay differentiates itself by:

- Hardware Integration: Pre‑installation on Transsion phones.

- Rewards‑Driven Model: Heavy use of cashback and discounts.

- Rapid User Growth: Surpassing 30 million users faster than many peers.

This unique combination of ownership, incentives, and distribution helps PalmPay compete in one of Africa’s most dynamic digital finance markets.

Conclusion

The co‑ownership of PalmPay by Transsion Holdings and NetEase, supported by Mediatek, illustrates the power of cross‑sector partnerships between mobile hardware giants and internet innovators. This strategy not only turbo‑charged PalmPay’s user acquisition but also set a blueprint for future collaborations in Africa’s fintech landscape.

As PalmPay continues to expand its services and deepen financial inclusion, its ownership structure and strategic values will remain central to its mission of transforming digital payments in Nigeria and beyond.